The the glocal real-time payments model landscape is undergoing a fundamental “glocal” transformation – blending global reach with local preferences. In a world of 24/7 commerce, consumers expect instant, convenient payment options suited to their local norms, even when sending money across borders netguru.coma16z.com. As a result, real-time payment networks have proliferated worldwide. For example, today more than 100 countries are experimenting with instantaneous payment technologies bis.orgthunes.com, and local payment methods now account for roughly two-thirds of global e-commerce transactions netguru.com. This “glocal” trend reflects the fact that local payment preferences are king – consumers may abandon a purchase if their favored method isn’t available netguru.com – while businesses seek the global efficiency of one interoperable system.

Figure 1: Hidden Fintech Trends 2025: What Banks Don’t Want You to Know(https://www.netguru.com/blog/fintech-trends)

Real-time payments deliver funds between banks in seconds, any time of day. They can be account-to-account transfers (often via QR codes or UPI-style IDs) or card-based rails (e.g. Visa Direct) that connect networks globally. Major trends include mobile money, QR-code payments, and national instant transfer schemes. In India, for example, the Unified Payments Interface (UPI) uses QR and UPI IDs to move rupees instantly between bank accounts pib.gov.inkansascityfed.org. In Brazil, Pix – an instant credit-transfer system from the central bank – lets Brazilians send reais within seconds bis.orgbis.org. In Europe, the Single Euro Payments Area (SEPA) has extended credit transfers and direct debits across 36 countries, and launched SEPA Instant (SCT Inst) in 2017 to settle euro payments in under 10 seconds europeanpaymentscouncil.euwholesale.banking.societegenerale.com. Globally, fintech innovators (from mobile wallet operators to cross-border platforms) are building on these rails. Notably, by 2025 India’s UPI may account for nearly half of all real-time payment transactions worldwide pib.gov.inkansascityfed.org.

Figure 2: Instant payments Global Adoption(https://www.aciworldwide.com/blog/real-time-payments-have-gone-mainstream-explore-their-global-impact)

Key real-time payment networks include:

- Unified Payments Interface (UPI) in India – 24/7 interbank instant transfers using QR codes/IDs pib.gov.inkansascityfed.org.

- Pix in Brazil – Central Bank of Brazil’s real-time payments launched 2020 (over 149 million users) bis.orgbis.org.

- SEPA Instant Credit Transfer (SCT Inst) – SEPA Instant embodies glocal payments by linking local banks into a pan-European instant rail. EU scheme (since 2017) enabling euro transfers in seconds europeanpaymentscouncil.euwholesale.banking.societegenerale.com.

- Faster Payments Service (UK) – live since 2008 for GBP instant transfers.

- FedNow and RTP (US) – FedNow (launched 2023) and The Clearing House’s RTP (2017) provide 24/7 USD settlement between banks wolterskluwer.comwolterskluwer.com.

- Mobile wallets and P2P services – e.g. China’s WeChat Pay/Alipay, Africa’s M-Pesa, and dozens of local QR-initiated schemes.

These modern rails contrast sharply with legacy networks. SWIFT, created in 1973, is a global messaging system for international banking, but it does not settle funds itself thunes.comthunes.com. Traditional cross-border transfers require correspondent banks and can take days. SWIFT’s Global Payments Innovation (GPI, launched 2017) improved speed and transparency (60% of GPI payments now reach the beneficiary within 30 minutes thunes.com), but still relies on multiple bank-to-bank hops thunes.comthunes.com. By comparison, glocal real-time methods aim for true instant settlement. For instance, Visa Direct – Visa’s push for real-time movement – links over 11 billion endpoints, covers 160 currencies and 195+ countries usa.visa.comusa.visa.com, enabling fund transfers to cards or accounts worldwide in seconds.

This convergence of global platforms and local rails is at the heart of the “glocal payments” trend netguru.comusa.visa.com. Payment giants and fintechs alike are building one-stop solutions that plug into local systems. For example, Stripe and other international gateways let merchants accept multiple currencies and local methods via a single API stripe.comstripe.com. Visa and Mastercard offer direct APIs to hundreds of domestic networks and card schemes so funds can reach local bank accounts or wallets across the globe usa.visa.comusa.visa.com. Open Banking and Visa Direct connectivity mean a business in France can instantly send euros to a Spanish phone via SEPA Inst, or dollars to a U.S. bank via FedNow, all in a single flow. In retail e‑commerce, platforms increasingly integrate local payment methods (like iDEAL in the Netherlands or Oxxo in Mexico) alongside global cards to boost conversion. In emerging markets, mobile-money rails plug into international remittances. In short, today’s financial rails must be global in reach but local in flavor netguru.coma16z.com.

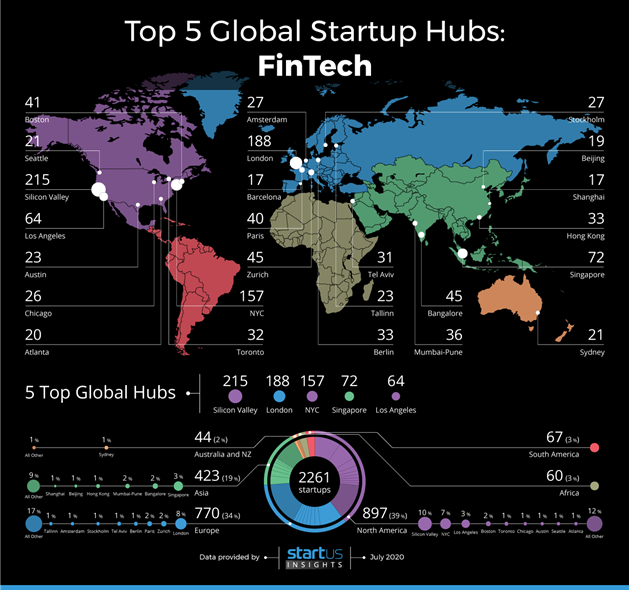

Figure 3: The Top 5 Hubs for FinTech Startups Globally(https://www.startus-insights.com/innovators-guide/these-are-the-top-5-hubs-for-fintech-startups-globally/)

Case Study: UPI – India’s Real-Time Payments Success in Glocal Finance

India’s UPI is a poster child for glocal real-time payments. Launched in 2016 by NPCI/RBI, UPI links bank accounts via QR codes or IDs on smartphones. It has exploded in usage: by Oct 2024 Indians made ~16.6 billion UPI transactions worth ₹23.5 lakh crore (USD ~314B) in one month, a 45% year-on-year jump pib.gov.in. Over 632 banks and 350 million users are on UPI, using it at 340 million merchant QR codes nationwide kansascityfed.orgpib.gov.in. Today UPI handles roughly 75% of India’s digital retail payments kansascityfed.org. Notably, India’s central bank allows multiple fintech “payment apps” (like PhonePe, Google Pay, Paytm) to coexist, all routing through the common UPI rails kansascityfed.org. This open, interoperable design accelerated adoption: users can pick any UPI app, but still send money instantly to any bank or app.

UPI shows how glocal payments can scale nationally while shaping cross-border adoption. NPCI has enabled cross-border UPI exchanges: Indians can use UPI in the UAE and Nepal today, and soon in the UK, France, and Bhutan pib.gov.in. In 2024 RBI even licensed WhatsApp Pay (via UPI) to tap India’s massive messaging base. As a sign of scale, a 2024 report notes India accounted for ~49% of global real-time payment volume pib.gov.in – dwarfing many Western systems combined. This shows how a local-centric solution can dominate the global RTP landscape. UPI’s success came from combining local strengths (Hindi/English app UI, rupee rails, Aadhaar/KYC ID) with a global vision for instant, interoperable payments kansascityfed.orgpib.gov.in.

Figure 4: Unified Payments Interface (UPI) logo – India’s instant mobile-payments platform pib.gov.in.

Case Study: Pix – Brazil’s Instant Platform

Brazil’s Pix is another national fast-payments marvel. Launched in Nov 2020 by the central bank, Pix allowed Brazilians to transfer reais between banks 24/7 in seconds. It took off immediately: as of Dec 2023 149 million people and 15 million businesses had activated Pix bis.org. According to BIS research, Pix cost only about $4 million to develop, but by 2021 it had already saved the economy $5.7 billion (by reducing cash/cheque use) and is projected to contribute ~2% of Brazil’s GDP by 2026 bis.org. Pix now handle billions of transactions per month – for peer-to-peer, consumer-to-business and even some B2B transfers – all in real time.

Fintech companies quickly integrated with Pix. For example, payment processor PPRO introduced Pix Automático for recurring bill-pay, letting subscriptions and invoices be auto-paid via Pix pymnts.com. Money apps and digital banks added Pix support or QR wallets. Unlike SWIFT wires or bulk ACH transfers, Pix strikes instantly: in March 2025 there were 182 million B2B Pix transfers (3% of volume) accounting for 46% of Pix’s value, reflecting that businesses now pay each other via Pix as well fasterpaymentscouncil.org. Thus, Pix’s design – free for individuals and ubiquitous for merchants – married local convenience (real-time, smartphone-friendly) with potential global reach (cross-border P2P remittances via digital currencies or future Pix-linking protocols). Brazil’s regulators and banks have leveraged Pix to accelerate digital finance inclusion, similarly to India’s UPI approach.

Figure 5: : Pix logo – Brazil’s instant payment system launched by its central bank (Banco Central do Brasil)( https://walcybank.com/pix-payment-method-the-new-instant-payment-system/)

Case Study: SEPA Instant – Europe’s Unified Payments

Europe’s Single Euro Payments Area (SEPA) strives to harmonize payments across 36 countries. Traditional SEPA credit transfers and direct debits have long enabled pan-European euro transactions under common rules. SEPA Instant Credit Transfer (SCT Inst), launched in 2017 by the European Payments Council, added real-time capability: up to €15,000 can move between any participating EU/EEA bank in under 10 seconds, 24/7 europeanpaymentscouncil.eu. This preempted a potential patchwork of national schemes (France and UK nearly started their own) and preserves the single-market vision europeanpaymentscouncil.eu.

Figure 6: SEPA-payment-featured(https://www.aciworldwide.com/sepa-instant-payments)

Recently, EU regulators stepped in to spur adoption. The new Instant Payments Regulation (IPR) (effective 2024–25) mandates that all euro-zone banks must offer SEPA Inst for incoming transfers by Jan 2025 (and for outgoing by Oct 2025) wholesale.banking.societegenerale.com. Early results are promising: the ECB reports that daily SEPA instant payment volumes jumped 72% in 2024 vs. 2023 wholesale.banking.societegenerale.com. However, uptake is uneven – individuals (P2P and C2B) are heavy users of instant credit transfers, whereas corporate treasuries remain more cautious wholesale.banking.societegenerale.com. In the broader market, Europe processed ~52 billion retail transactions in the first half of 2024 ecb.europa.eu, illustrating the massive scale at stake. In essence, SEPA Instant is Europe’s answer to “glocal” needs: it ties together diverse countries under one instant-euro umbrella, bridging local banking infrastructure with global business flows europeanpaymentscouncil.euwholesale.banking.societegenerale.com.

Figure 7: Overview- Index Performance Scores(https://paymentsnext.com/fintech-here-there-globally-deloitte-adds-24-new-fintech-hubs/)

Integrating Global Platforms with Local Rails

Fintech globalization is all about connectivity. Modern payment platforms link global endpoints into local schemes. For instance, Visa Direct connects card endpoints to domestic real-time systems worldwide: its 2024 stats show 11+ billion endpoints, 160 currencies, 195+ countries/territories on one network usa.visa.comusa.visa.com. Likewise, Wise (TransferWise) or Revolut let businesses hold multi-currency accounts and send money instantly to local banks by using a patchwork of local rails behind the scenes. Even big tech players are entering: Meta’s Facebook/WhatsApp Pay (via UPI in India or planned via SEPA in Europe) leverages local rails under a global app brand.

International payment gateways abstract away local complexity. As Stripe notes, an “international payment gateway” authorizes transactions in multiple currencies, accepting local payment methods in each market stripe.comstripe.com. Businesses that expand globally rely on these gateways to meet local consumers’ habits: e.g. a German seller accepting iDEAL in the Netherlands or Boletos in Brazil through one integrated platform. The key is agnostic integration – connecting once to an API that internally routes the money via the optimal local network. This is the essence of a glocal payment solution.

Fintech startups specialize in stitching networks together. Cross-border platforms like PayPal, Alipay+ (via partners), and blockchain-enabled remittance firms are building “overlay” networks that interpret a payment instruction and automatically route it through the appropriate local instant-transfer system or correspondent route. Open banking APIs also help: banks expose payment APIs in countries from the UK to Australia, letting fintechs originate instant transfers directly. Additionally, stablecoin wallets and CBDC experiments (e.g. m-CBDC bridge) are being designed to interoperate with existing rails, further blurring lines between “global” money and “local” payment.

Regulatory support has been crucial. India’s NPCI set up UPI with light-touch rules (and tiered bank participation) to encourage innovation pib.gov.inkansascityfed.org. Brazil’s central bank provided incentives (and fee waivers) to push Pix everywhere bis.org. Europe’s PSD2 and IPR initiatives force banks to enable instant transfers and APIs. Even the US Federal Reserve laid out rules (Regulation J, Regulation E) governing FedNow, making it clear that 24/7 instant rails must adhere to uniform compliance standards wolterskluwer.comwolterskluwer.com. Thus, fintech regulation is shifting from static compliance to actively promoting interoperability.

Legacy Systems vs. the New Real-Time Era

Traditional cross-border payment rails like SWIFT still exist, but they’re rapidly being challenged. SWIFT remains the backbone “messaging layer” for many international transfers thunes.com, and correspondent banking still moves the funds. However, this old model is slow and opaque. As Thunes notes, even with SWIFT GPI 60% of payments reach the beneficiary within 30 minutes and almost all within 24 hoursthunes.com – much faster than old multi-day transfers, but not true real-time. By contrast, modern networks aim for sub-second settlement.

Comparisons highlight the gap: SWIFT GPI connects 4,450+ banks (as of 2025) sending ~$530 billion dailythunes.com, but it still requires multiple middlemen for a payment to reach the end. Meanwhile, RTP systems in Asia or Europe can eliminate many of those steps. For example, Japan’s Zengin instant system connects virtually all banks (50+ years old), and China’s CIPS (for Yuan) links directly through the central bank. In Latin America and Africa, new real-time networks like PIX and M-PESA have all but replaced cash for day-to-day transactions. Even on the global stage, consortiums and crypto networks offer alternatives: Ripple’s On-Demand Liquidity provides near-instant dollar transfers using stablecoins, and JPMorgan’s blockchain network is piloting real-time FX settlements.

The end result: legacy systems are adapting. SWIFT itself launched SWIFT Go for small transfers, and continues to refine GPI. Card networks (Visa/Mastercard) and fintechs are pushing into cross-border. But the new norm is “real-time where possible.” Businesses now expect tracking, transparency, and speed. According to industry data, nearly all SWIFT GPI payments settle within a day thunes.com, but customers increasingly ask “why can’t it be right now?” – a demand that glocal real-time solutions are built to satisfy.

Figure 8: SWIFT logo – the Society for Worldwide Interbank Financial Telecommunication(https://www.mint2save.com/swift-route-to-international-payments/)

Opportunities and Challenges in the Glocal Landscape

This glocal, real-time shift offers major opportunities:

- Seamless global commerce. Instant cross-border transfers let SMEs pay international suppliers without cashflow lag, and offer shoppers anywhere the convenience of local payment checkout. One study notes global e-commerce may grow from $7 trillion to $11 trillion by 2025 netguru.com, spurred by better payment systems.

- Financial inclusion. Millions of unbanked consumers can leapfrog traditional banks via mobile wallets tied to real-time rails kansascityfed.orgbis.org. For example, UPI and Pix have on-ramps to credit and savings services. Regulators in emerging markets see instant payments as a way to bring informal economies on the grid.

- Innovation for fintechs. Startups can build “plug-and-play” global apps that localize themselves automatically. We’re already seeing IoT devices, e‑health apps, and B2B platforms integrating payment APIs with many rails at once. The glocal model means fintech entrepreneurs can tailor experiences per region while using shared infrastructure.

However, significant challenges remain:

- Interoperability and fragmentation. Many national instant systems exist, but cross-border links are still spotty. For example, an Indian UPI app can’t send money directly to Brazil’s Pix yet; it needs an intermediary. The multitude of currencies and standards (QR codes, IBANs, national IDs) complicate matters. Global standards bodies (ISO 20022, UNCITRAL) and initiatives like SWIFT’s Link, or the Alliance for Innovative Regulation’s CorridorLink, are working to bridge gaps wholesale.banking.societegenerale.comeuropeanpaymentscouncil.eu, but it takes time and cooperation.

- Regulatory hurdles. Anti-money laundering (AML) and fraud controls become harder with instant flows. Faster schemes must implement real-time screening for suspicious activity. For instance, the US noted a spike in fraud on Zelle between 2020–22 fastpayments.worldbank.org. Regulators may impose stricter KYC or transaction limits, which can slow adoption of real-time features.

- Infrastructure costs. Banks and processors need to upgrade legacy core banking systems to run 24/7 and handle high volumes instantly. This requires investment in new switches, liquidity management tools, and system redundancy. Smaller institutions especially face burdens to join instant schemes.

- Consumer habits and trust. In some markets, people still prefer cash or established habits. Convincing users (and businesses) to switch entirely to digital real-time payments can take years, even with government pushes. Education and user experience design become critical.

Ultimately, glocal payments and real-time transfers are redefining how businesses and consumers experience finance worldwide. According to one industry report, roughly 20–50% of customers will abandon a purchase if their local payment method isn’t offered netguru.com, underscoring the importance of this transition. As fintech globalization advances, businesses must adapt by integrating both global rails and local options. Financial institutions and governments will need to collaborate on standards and oversight to reap the full benefits. But the payoff – a truly connected global economy where money moves instantly in any local context – promises to reshape how commerce and finance work worldwide.